This guide will show exactly how a cross-collateral mortgage works and how cross-collateralisation can hold back your property loans.

We will also cover the benefits, risks and issues you may face when refinancing with a cross-collateral mortgage.

If you’re looking at using equity to grow an investment portfolio and trying to build passive income from property, this guide is for you.

Let’s get started.

What Is Cross Collateralization?

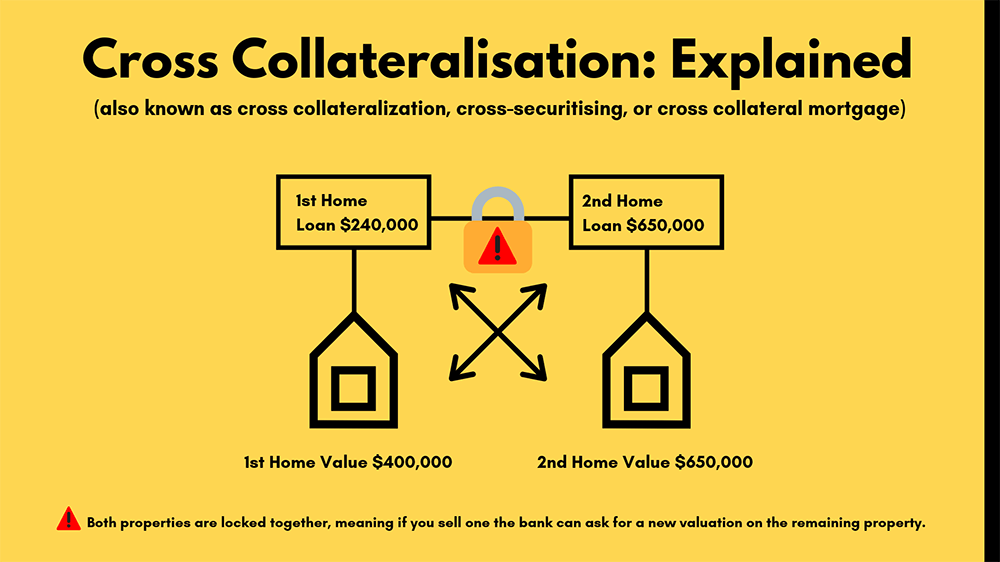

Cross collateralisation is a finance term used when a loan is secured by two or more properties.

If you have a home and want to borrow additional money for an investment property from the same bank, they often cross-collateralise or cross-secure the properties to lend you additional money.

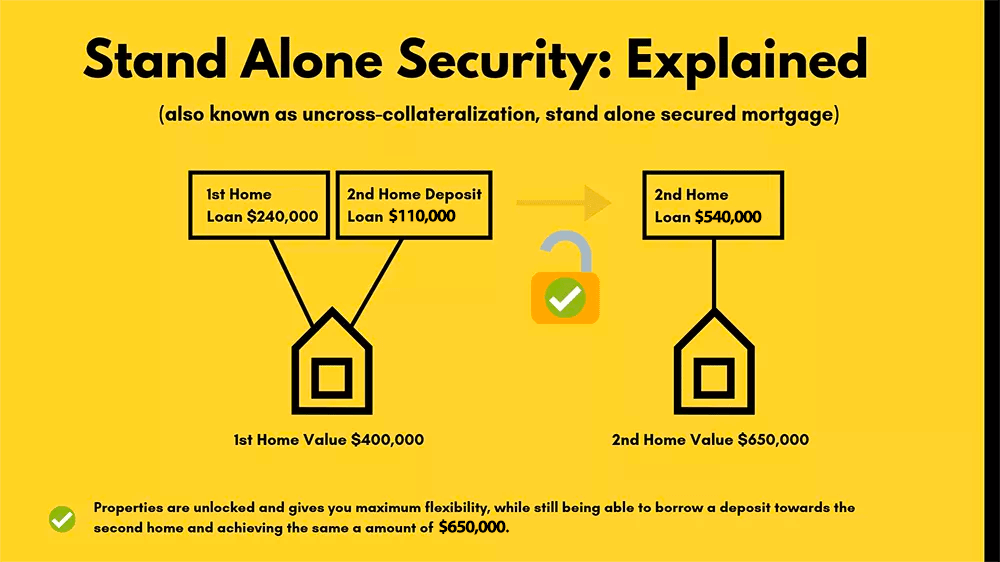

For example, if you’ve got an existing home that might be worth $ 400,000 and you’ve got an existing home loan of $ 240,000, you come to your bank or mortgage broker and say I want to buy a new home for $650,000. You can easily get a new loan of $650 000 using both your existing home plus the new investment property as security.

The typical buyer usually wants to hold onto their properties for 10 to 15 years and is not looking to purchase any other properties. But for those who want to build their portfolio, cross-collateralisation is usually very appealing. It also appeals to banks who get more security against your properties.

When Can Cross Collateralisation Be Used?

Cross collateralisation can be used in the following scenarios:

- When two properties are involved in securing a loan

- When the equity from one property (e.g. an owner-occupied property) is used to purchase a second investment property.

Benefits Of Cross Collateralization

Benefit 1: Borrow 100% of the property price

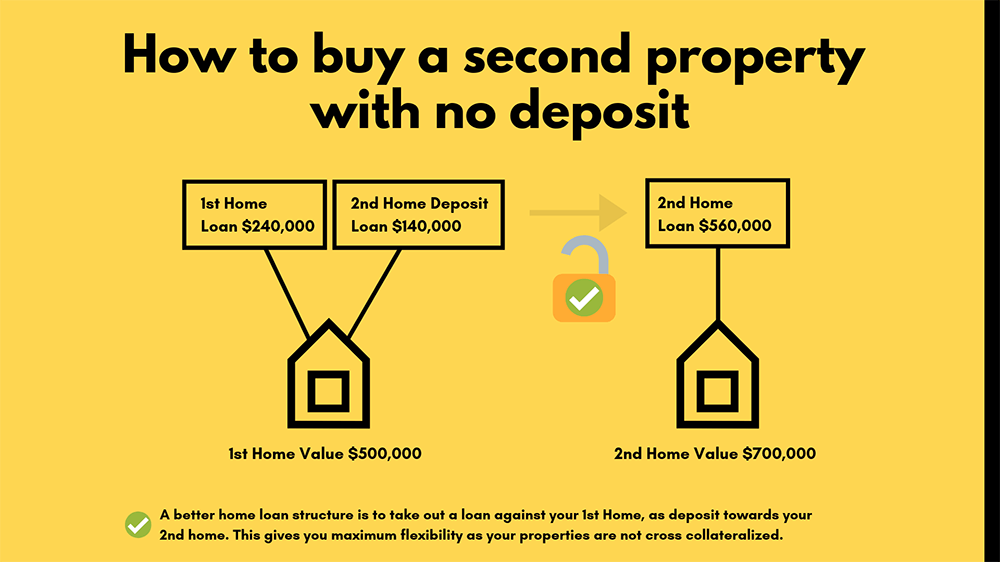

The obvious benefit of cross-collateralising is that you can borrow 100% of the new purchase price in one loan. It can be helpful to build your portfolio because it means you’re not having to outlay your 10% or 20% deposit. You’re actually borrowing the full purchase price for the new home using your equity.

Benefit 2: Higher borrowing capacity

If you’re cross-collateralising, you have to stay with the same lender as well, and the advantage is some banks will extend your borrowing capacity because it’s lower risk to them. Instead of having one property, they’ve actually got two on the hook if something goes wrong.

Benefit 3: Get a lower interest rate

When you’re cross-collateralising, you can sometimes get a better interest rate.

Why?

Some banks see this as a lower risk because your properties are combined instead of an individual investment loan. The savings can depend on the bank, the total lending amount, and the equity you have in your properties.

Benefit 4: Tax benefits

If your initial loan was for an owner-occupied property, and your next loan is for an investment, you might be able to make a tax claim. Also, if you’re using equity from it, then this is 100% tax-deductible.

Chat with your accountant about how your loan is structured and the tax benefits around it.

Benefit 5: Downsizing

If you plan on downsizing, then cross-securitising is for you. Combining your mortgage with one lender makes your portfolio more simple to manage as there are fewer individual account splits.

How To Qualify For A Cross-Collateralised Loan:

To qualify for a cross-collateralised loan, you must meet some very strict criteria:

- You will need to stay within the mortgage limits.

- If you use a guarantor, they will be required to guarantor all loans within the cross-collateralised structure

- Borrowers under this structure must be either a debtor or a guarantor

Read More: How to use equity to buy a second property.

What Are The Drawbacks Of Cross Collateralisation?

It’s very common for banks to want to cross-collateralise your properties together. It’s just less paperwork, which is a lot less effort for them. If you’re serious about cross-collateralising your loan, you must also understand its disadvantages and downfalls. The better you understand these, the more success you’ll have in working it in your favour.

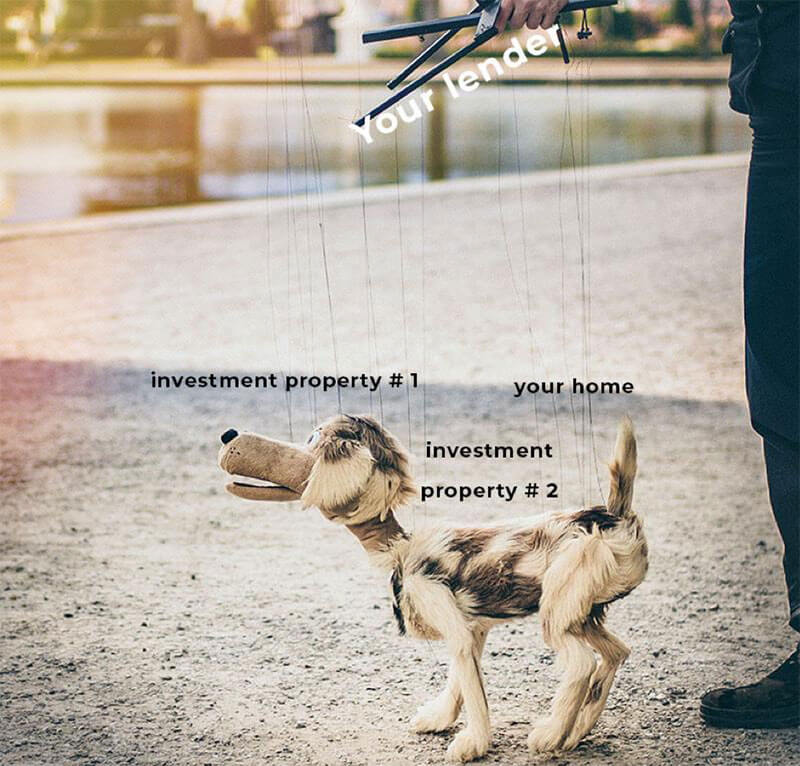

Cross-collateralising has drawbacks and risks; it is complex, can reduce flexibility and complicate your banking. In other words, you must have all properties with the one bank. It’s less risky for them because they’ve got two properties instead of one. So, if something goes wrong, they can have two properties to sell because they’re all tied together, and you can get caught out that way.

So make sure you really think about it before going ahead with cross-collateralisation.

Your lender will highly recommend it, but you should speak with a mortgage broker to know all the risks and limitations before setting up this structure.

Risk 1: Market downturns

The most significant risk is that all of your properties are connected. So, if 1 of your properties drops in value, this will affect your total portfolio.

Why? Because all your properties are linked— it is like a chain reaction.

Even if the equity in 1 property goes up and the other experiences a significant drop, this will limit your overall equity from increasing.

Risk 2: Losing power over your loan

Since your properties are all linked, issues can arise with the bank if you struggle to repay your home loan. If you fall behind on either of your other loans, you may risk losing your other property.

In this situation, the bank will tell you what you pay and when to keep the loan-to-value ratio in place so you don’t lose your home.

Risk 3: With refinancing a loan comes revaluing

The problem with cross-collateralisation is that when you want to refinance, EVERY property needs to be revalued—not just one.

Due to this, the costs can be much more extensive, and banks will have to get a Variation of Security.

This process can be time-consuming and also puts you at risk of the bank returning with a lower valuation and stopping you from refinancing.

Risk 4: LMI costs WAYYYYY More

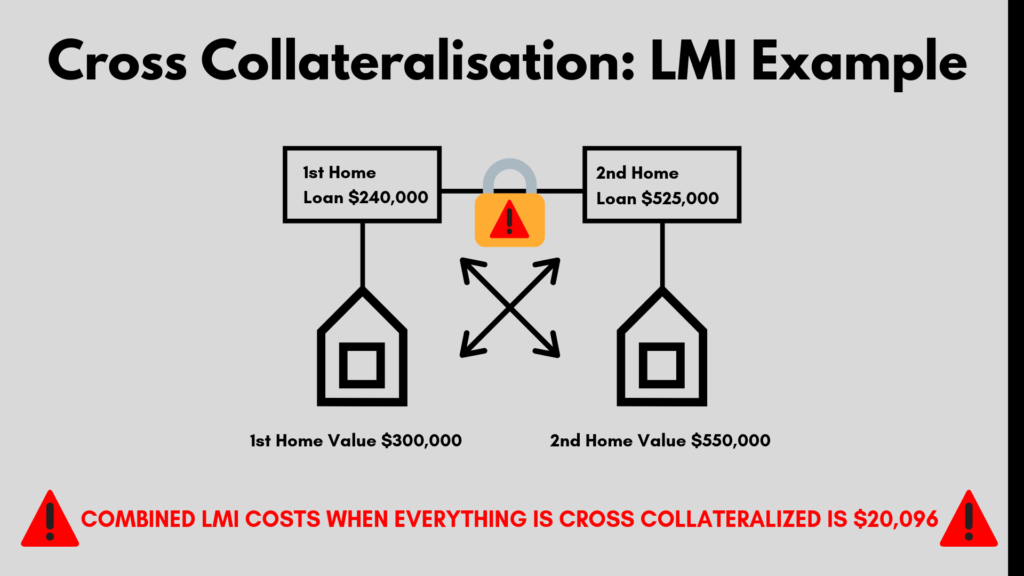

LMI is calculated on a sliding scale and generally costs more when your loan amounts are higher. If you have cross-collateralised loans, you could be paying thousands of dollars more.

Let’s look at a real-life example.

If you were buying a second property for $550,000 and were using equity from your original property of $300,000, you’d need to pay $20,096 in LMI costs.

Yep, that is a fair chunk of change.

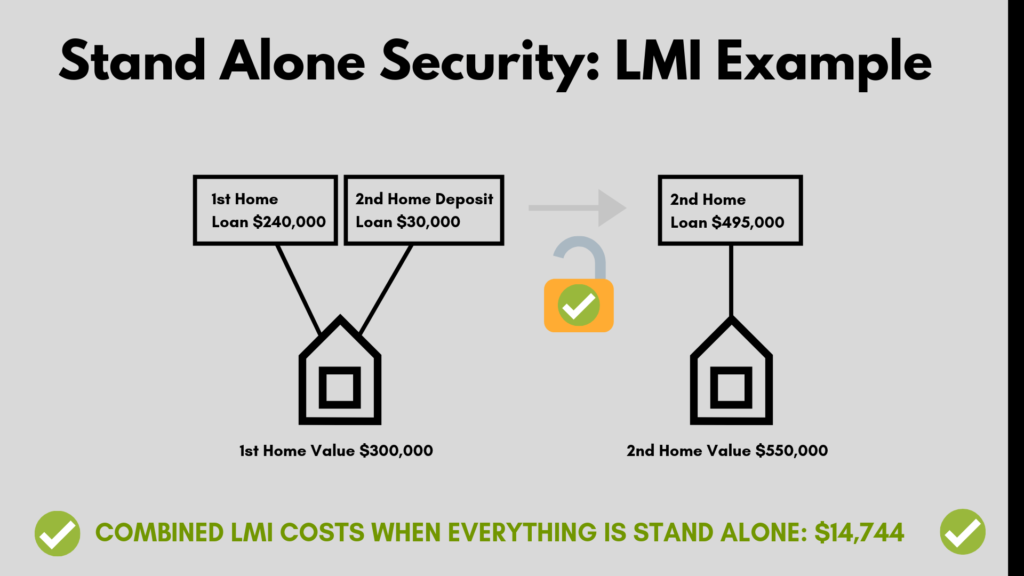

However, if you went for a stand-alone structure, you could save thousands!

What's The Difference With Stand-Alone Security?

The concept of stand-alone security is that a loan is secured by just one property. You can also use this method to build your property portfolio. For example, you could use your family home as stand-alone security.

Stand-alone or Cross Collateralisation?

Generally speaking, stand-alone is recommended over cross-collateralisation.

This is because, with cross-collateralisation, it can become very difficult to ‘untangle’ the different properties. Stand-alone removes this unnecessary risk.

With cross-collateralisation, if you had three properties ‘tied together’ but wanted to sell one of them, you would have to do the following:

- Value the other two properties

- Reassess your financial position (which could come at a bad time financially)

- Require new mortgage documents to be issued.

Instead, if the properties are structured as stand-alone, you could sell any property and pay it out with the loan secured by it. The lender will not get involved in the current debt or other properties with things like valuations and reassessments.

What Are Some Other Things I Need To Keep In Mind?

Alongside the risks, you also need to consider other factors, like lenders mortgage insurance or selling your property in the future.

Lenders Mortgage Insurance

Unfortunately, the total lending is secured against all the properties. The lender’s mortgage insurance premium is calculated on the total lending and could cost thousands of dollars.

So, if you want to borrow more than 80% of the value of one investment property, then lenders mortgage insurance will become applicable.

This is applied if there isn’t enough overall equity in the properties.

Read More: LMI Calculator

Selling or future plans

When your loans are cross-collateralised, and you decide to sell one, the bank will revalue the properties that will be held once the sale is completed. They’ll decide and control the sale funds and can demand that the sales funds be used to pay down the debt. This can be frustrating, especially if you require the sales proceeds for other purposes.

Ease to move

It may be costly to move your portfolio if your lender is no longer right for you.

For example, if you require additional funds and your lender declines, or if they can no longer offer you competitive rates, the natural thing to do is find another lender.

But the restricting scenario of cross-collateralisation can significantly affect your loan structure and make it difficult to refinance to another lender.

How To Minimise Risk

A great way to reduce risk around your loans with multiple properties is by working with at least two primary lenders. Buyers often separate their home and investment loans by splitting them between different lenders.

While it is easier just to have 1 lender take care of everything, spreading your loans around will work to your advantage if you get into financial trouble.

But keep the future in mind and always give yourself extra security to ensure you minimise risk.

How To Know If A Cross-Collateralised Loan Is Right For You

Are you wondering if cross-collateralisation is for you? Book a free assessment to talk to one of our expert Hunter Galloway mortgage brokers. We will help you determine what’s best for your personal situation.

If you are buying or refinancing your home, we can also help walk you through the process. Unlike other mortgage brokers who are just one-person operations, we have an entire team of experts dedicated to helping make your home loan journey as simple as possible.

If you want to get started, please give us a call on 1300 088 065 or book a free assessment online to see how we can help.

Our service does not cost you anything, as we are paid by the lender when your home loan settles.

To chat about your deposit, lending and investment lending options, book a time to sit down with us or feel free to call on 1300 088 065.

The information on this page is general in nature and should not be considered advice. Before you act on this information, you must seek independent legal and financial advice.

More Resources For Homebuyers:

Looking for more resources for homebuyers? We’ve got you covered. Here are a few articles we’d recommend you read next.

Start again

Start again