If you’ve ever compared home loans and wondered why the rates don’t quite match up, you’re not alone. That’s where the comparison rate comes in — it helps you see the real cost of a loan, not just the shiny interest rate on the ad. In this guide, we’ll break down exactly what a comparison rate means, how it’s calculated, and how it can help you make smarter home loan decisions. And if you’re still unsure, a mortgage broker in Brisbane can walk you through the options and find a loan that truly fits your goals.

Let’s dive in..

Table of Contents

What Is A Comparison Rate?

A comparison rate is a way to represent the total cost of your loan.

According to ASIC, a comparison rate turns the cost of your loan fees, interest rates and other charges into a percentage. It is there to show the true cost of your loan and is used to compare different loans.

But what’s the catch?

The comparison rate doesn’t take into account payment terms, upfront fees, establishment fees and other associated costs.

So, in reality, it can miss out on a lot of extra costs.

What Does It Cover?

There are a few key things that the rate covers, including:

- The interest rate of the loan

- Some Fees

- Loan terms

- Loan amount

- Frequency of repayments

A comparison rate is a good way for borrowers to compare loans as it gives a nice estimate of all costs involved.

But remember that this is just one part of the loan and does not consider all the other features you might want from a loan. You should only choose a loan that aligns with your financial goals. For example, the comparison rate is not a very helpful tool if any of the below features are a priority to you:

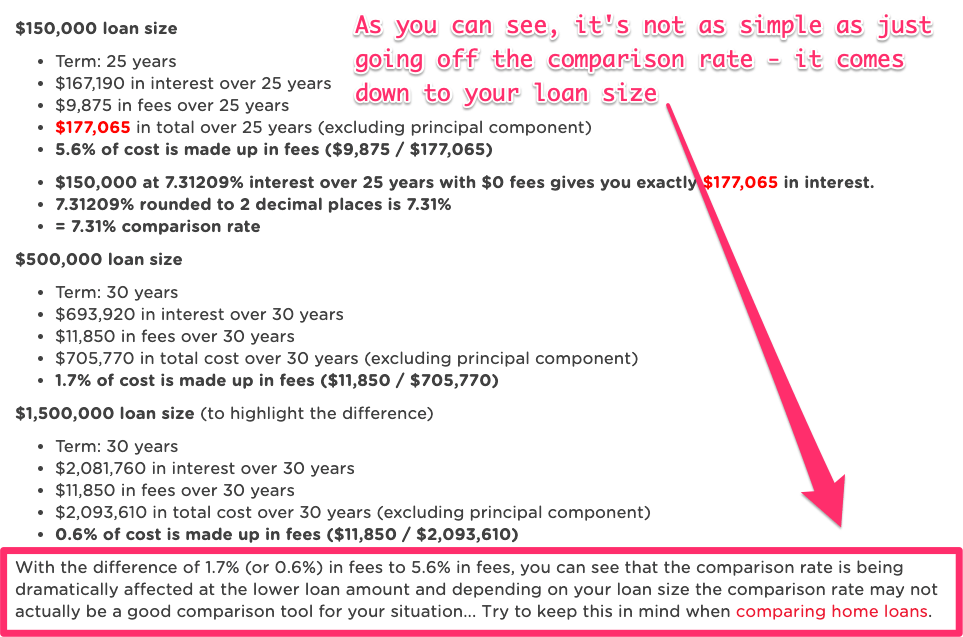

- Understanding the true costs of all loan amounts. All advertised comparison rates are based on a $150,000 loan over a 25-year loan term. If you are going to make extra repayments to your loan or are borrowing a higher amount, the Comparison Rate won’t be a true representation of the actual costs of your loan.

- Redraw facility. If a loan offers a redraw facility, you may choose it despite the higher comparison rate. Redraw facility provides you access to the extra cash you deposit in the home loan.

- Offset account. You may choose a loan despite the higher comparison rate if it has a linked offset account. An offset account is a transaction account that is connected to a mortgage account. It decreases the overall interest payments because the interest rate is applied to the net balance. The net balance equals a mortgage balance less the balance of the offset account.

- Opportunity to make extra repayments. There are some loan packages that allow you to make extra repayments. This offers flexibility and makes it easier for you to meet your financial obligations.

To get a more in-depth understanding of whether a better comparison rate has priority over these kinds of features, chat with our team of Brisbane mortgage brokers. We will explain the comparison rate mechanism in detail, tell you the impact of this rate on the repayment terms of a loan and explain other features.

What Is The Difference Between The Comparison Rate And The Interest Rate?

The difference between a comparison rate and an interest rate is unclear to most people.

But two keywords will help you differentiate between the two. These are True Cost.

An interest rate simply looks at the interest on the loan and nothing more.

The comparison rate is about figuring out the true cost of the loan. It compares loan fees and charges, terms and repayment frequency.

Many homebuyers are always surprised to hear that a lower interest rate doesn’t always mean it’s the best loan option.

This is where the comparison rate comes in. However, as we mentioned earlier, there are other factors you should consider, such as features that are beneficial to your personal circumstances. These can have more weight in decision-making.

How Is The Comparison Rate Calculated?

To understand a comparison rate entirely, you need to understand how it is calculated. Fortunately, figuring it out is easy.

A comparison rate can be calculated in three steps. In fact, no matter the loan size, the basic formula includes these three things:

- The loan amount – let’s say your loan is $500,000

- The loan term – the standard home loan term is 30 years

- Whether it’s principal and interest or an interest-only loan (for this example, let’s say P&I)

So for a Commonwealth Bank Extra Home Loan, the advertised comparison rate is based on a $150,000 loan over a 25-year term, so it’s not going to be accurate for your situation:

- 4 Year intro variable rate (First Home Buyer)

- Interest rate: 4.62%pa LVR 70% (accurate as of 16 December 2022)

- $0 establishment fee

- $0 monthly loan service fee

- Additional fees may apply

- The comparison rate is 4.63%.

Why isn't it applicable to my situation?

On the website, the comparison rate is calculated on a $150,000 loan, but you want a $500,000 loan.

So what you’re seeing is that a comparison rate of 4.63% isn’t an accurate example of your loan size.

In this case, if you’re looking for a higher loan, you’re essentially being misled by what the bank is showing you online.

Next, we need to see what the comparison rate is based on your actual loan size.

Let’s look at how the rate differs and how the fees affect the overall costs of your home loan for a higher loan.

How Can The Comparison Rate Be Used?

In a few ways, actually.

If you’re applying for a loan, you’ll need to look at all the different variables and features on offer. But comparing loans with different time-frames, interest rates, and fees can be complicated.

This is where a comparison rate comes in and how you can use it.

So let’s take a look at an example:

Jill is trying to decide between two different loans. The first (Loan A) provides an interest rate of 5% with other charges of about 1%. The second (Loan B) has a 5.45% interest rate and 0.5% in other charges.

When we add the two percentages together, this creates a comparison rate.

So for Loan A, the comparison rate is 6% (5%+1%), and for Loan B, the comparison rate is 5.95% (5.45%+0.5%).

When we look at these two loans side by side, We can see that while Loan A provides a better interest rate, the overall cost of B works out a little lower.

So, in short, that’s how a comparison rate is used.

What Comparison Rate Doesn't Include

Just like many pieces of advice you will be given, a comparison rate is there only to guide you, not to be the final decision point.

Why?

Because comparison rates miss out on the finer details and every little extra cost.

- It leaves out things like break fees, redraw fees, late payment fees, and external charges, which can vary between loans.

- Comparison rates also miss government fees and other non-mandatory fees that may be imposed, like optional fees for redraw or offset accounts.

- Comparison rates shown are based on a $150,000 loan with a 25-year loan term. If your loan isn’t close to this, then the number you’re seeing isn’t an accurate reflection of your comparison rate.

To help you overcome these drawbacks, speak directly to your mortgage broker about how this will affect your loan.

Does The Comparison Rate Make Big Difference?

A comparison rate can simplify decision-making by revealing the hidden costs and showing a total number that can be used to compare between 2 loans. So, between two loans with the same interest rate, you can see the variable factors that set them apart.

No two loans are the same, and a comparison rate shines a light on the differences.

So, a comparison rate is a good starting point to help your decision-making process between two loans on offer.

Most Common Mistakes

According to the Australian Bureau of Statistics, Australia has one of the highest levels of home ownership in the world.

This means that home loans are in hot demand!

As you know, setting up a home loan is about finding the best rate for you. If you don’t do your research properly and use a comparison rate to your advantage, you could be losing money each year on your loan.

So, here are some of the most common comparison rate mistakes and how to avoid them:

Mistake #1—Relying on a comparison rate ONLY to help you choose a loan

The main mistake we see buyers make before they speak to us directly is relying completely on the comparison rate to do all the work.

Remember that comparison rates are product-specific and do not include a particular loan’s features and other inclusions. This means offset accounts, redraw fees, credit cards, and insurance savings are not included in this number or comparison.

Mistake #2 — Thinking all rates are created equally

Comparison rates don’t look at different types of loans, which means that fixed-rate and variable-rate loans are dumped into the same category, together with the loan size.

So, the comparison rate you’re seeing is only for a $150,000 loan, not your specific loan size.

This is where problems can occur.

For example, fixed-rate loans can be misleading because it is assumed that once the fixed period is over, the rate continues as a standard variable rate.

But here’s the catch.

If you’re like most borrowers, once the fixed rate period is over, you will refinance. Refinancing saves you money because you can get the best available rate at the time.

…Usually, even lower than the regular one because the lender will offer you a deal.

Comparison rates can’t predict this.

Frequently Asked Questions

What is a home loan comparison rate?

A comparison rate combines the loan’s interest rate with most upfront and ongoing fees into a single percentage. It helps you understand the true cost of borrowing and compare loans more accurately.

Why is the comparison rate higher than the advertised rate?

The comparison rate includes extra fees and charges that the advertised rate leaves out. This makes it a more realistic reflection of what you’ll actually pay over time.

How is a comparison rate calculated?

In Australia, it’s based on a $150,000 loan over 25 years and includes the interest rate plus standard fees. This consistent formula allows borrowers to compare loans on equal footing.

Is the comparison rate always accurate for my situation?

Not always. It’s a guide based on a sample loan, so your actual costs can differ depending on your loan size, term, and specific fees.

Do all lenders have to show a comparison rate?

Yes. Under the National Credit Code, all lenders and mortgage brokers must display a comparison rate whenever they advertise an interest rate.

What types of fees are included in the comparison rate?

It generally includes application, settlement, monthly, annual, and discharge fees. These are the most common costs that affect the overall cost of your loan.

What’s not included in a comparison rate?

Government fees, lender’s mortgage insurance (LMI), and optional feature costs like offset accounts are excluded. These vary depending on your personal situation and how you manage your loan.

Why is the comparison rate important when choosing a home loan?

It helps you identify loans that might look cheap at first glance but come with hidden fees. Comparing the rates side by side gives you a clearer idea of long-term affordability.

Can the comparison rate change over time?

Yes, if your lender changes fees or your loan conditions change, the effective comparison rate can shift. It’s always worth reviewing it regularly to ensure your loan still offers value.

Do fixed and variable home loans have different comparison rates?

Usually, yes. Fixed-rate loans often show higher comparison rates because they include higher setup costs or revert to a higher variable rate after the fixed period ends.

Should I only use the comparison rate to choose a home loan?

No, it’s just one part of the picture. You should also consider features like offset accounts, flexibility, and repayment options that could save you money.

How can I find the best home loan comparison rate?

You can use online comparison tools or speak to a mortgage broker who can compare rates across multiple lenders. A broker can also help match you with loans that suit your goals and budget.

Read More: How to find the Best Home Loan

Next Steps And Getting Your Home Loan…

Do you have any questions about the comparison rate? Or are you ready to buy a home?

Our team at Hunter Galloway is here to help you buy a home in Brisbane. Unlike other mortgage brokers who are just one-person operations, we have an entire team of experts dedicated to helping make your home loan journey as simple as possible.

If you want to get started, please call us at 1300 088 065 or book a free assessment online to see how we can help.

Start again

Start again