Welcome to our latest (March 2025) Australian Property Market Update, where we explore the latest trends and factors affecting the property market in 2025.

In this article, we will provide an in-depth analysis of the current state of the Australian property market for home buyers and investors looking to navigate the market alone or with the help of a mortgage broker in Brisbane.

Let’s dive in.

Key Highlights For This Month

CoreLogic reports that the total value of residential real estate remained at $11.2 trillion in February.

- National home prices dropped by 0.1% over the past three months, with capital city prices falling by 0.4% while regional areas saw a 1.0% increase.

- There were 40,085 property sales in February, bringing the total for the past 12 months to 532,244. Although this is 6.2% higher than last year, sales activity has slowed in the last three months.

- Homes are taking longer to sell, with the national median time on the market increasing from 27 days in Q3 2024 to 42 days in the past three months.

- Sellers have been offering slightly bigger discounts, with the average national discount rate rising from 3.5% at the end of spring to 3.6%.

- Rental price growth has slowed, with rents rising 4.1% in the year to February, down from an 8.3% increase in the year to March 2024. Although rents rose by 1.1% over the last quarter (compared to a small drop in Q3 2024), the overall annual growth trend will likely continue slowing.

Table of Contents

What's Happening In The Australian Property Market.

The data shows that some parts of the market are showing signs of recovering after the recent interest rate cut, while others are still in decline. New residential property listings were 41,416 nationwide in the 4 weeks to 2 March 2025.

The total number of sold properties in the 12 months to February 2025 was 532,244, which is 6.2% higher than the previous 12 months. However, in the 3 months to February, sales slowed significantly. This suggests a slowdown in sales caused by weaker value growth.

Property growth and the supply of dwellings have had a pretty big impact, outweighing the effects of the cash rate. Australia’s population grew by 552,000 people over the year to December 2024, an increase of 2.1%.

We’ve also seen consistently high auction clearance rates, which are signs of a healthy market. Sales volumes surged 6.2% compared to last year. In various cities across Australia, the pace of quarterly growth has continued to ease. However, the change in home values varies across cities, with some places setting new property price records. Prices are expected to continue rising in 2025, but the forecasts vary from city to city.

The RBA cut interest rates by 25 basis points on18th of February. This brought much-needed relief and opened opportunities for first homebuyers and investors alike. However, mortgage affordability has been at its worst in over 3 decades, which may slow down the rate of growth in the property market.

It’s important to remember that property market trends can be cyclical, and downturns often present opportunities for savvy investors to secure properties at a lower price point. Let’s take a look at the market data in more detail.

Migration hotspots and impact on housing trends

We’ve seen a big spike in migration from people moving within the country—from state to state—and from overseas arrivals. Overseas migration is the one to watch, so let’s examine how this impacts the housing market.

The data says a huge percentage of overseas migrants rent rather than buy straight away. More renters mean landlords can raise rental prices, which means more investors want to enter the market. This tends to push up property prices over time, and we certainly see this in certain parts of Sydney and Melbourne. Melbourne CBD recently saw a significant overseas migration, and rents there are up nearly 30% in the past year.

You may be thinking that this is probably something more for investors to pay attention to because it potentially shows the propensity for rent to increase and increase their return in the future, right? But if you’re a first home buyer, you’re often competing with investors. Both investors and first-home buyers are often looking at similar types of properties. So, if an area becomes attractive to investors, you will face more competition when you negotiate the price of the property.

Australian Dwelling Values Overview

The Australian property market has experienced some fluctuations over the past year. However, recent data suggest a cooling down in the market.

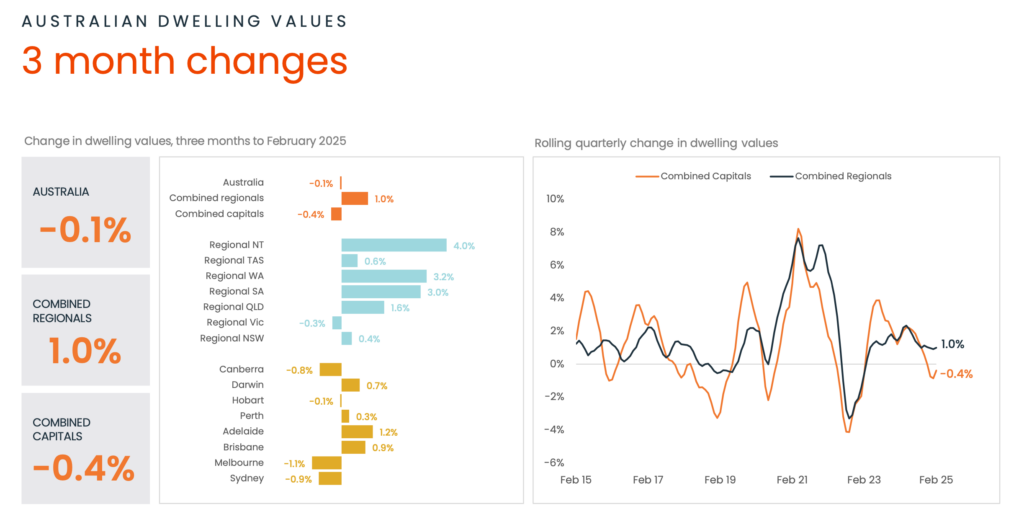

National home values fell by -0.1% in the 3 months to February 2025, caused by a 0.3% increase in the past month. Over the past 12 months, dwelling values in Australia have risen by 3.8%. Overall, these changes show that the market is easing but still presents an optimistic outlook for the Australian property market.

Overall changes in dwelling values across Australia

Australian Dwelling Values - Past 3 months

The Australian property market is always evolving, and the latest data suggests that there have been some ups and downs over the past few months.

But don’t despair—there are still some areas of growth that we can celebrate. The 3-month changes in Australian dwelling values present a snapshot of the current state of the market, showing some regions experiencing growth and others experiencing a decline.

While there was a modest decrease of -0.1% in national home values in the past 3 months, it’s worth highlighting that among the capital cities, Adelaide has experienced the most significant growth of 1.2%. However, the rate of growth is also slowing down in Adelaide.

Regional Vic is the only regional area to have experienced declines, with values declining at an increased rate of -0.3%. In the capital cities, dwelling values have increased over the past 3 months in Darwin, Perth, Adelaide and Brisbane. Canberra (-0.8%), Hobart (-0.1%), Melbourne (-1.1%) and Sydney (-0.9%) have experienced declines.

Australian Dwelling Values - Past 12 months

The Australian property market is always in flux, with the latest 12-month data showing a mix of growth and decline.

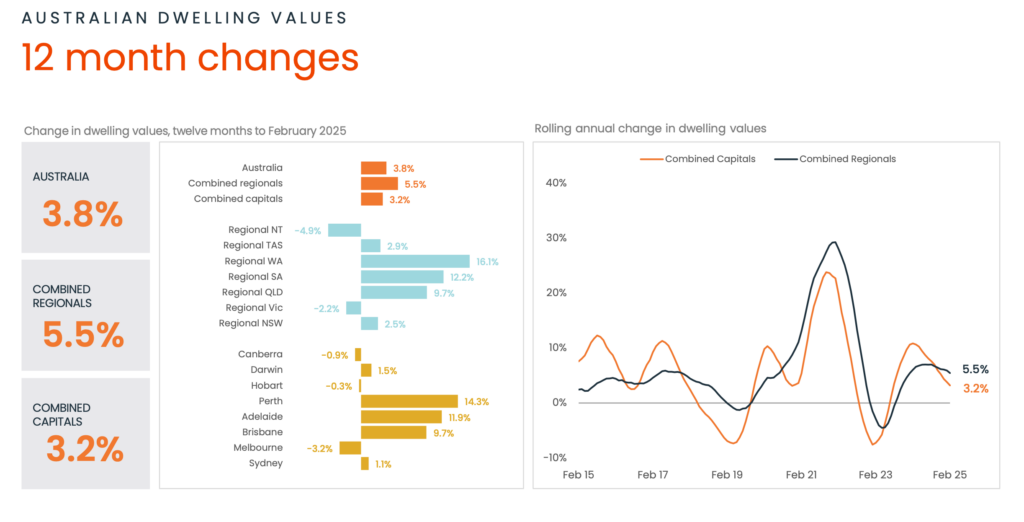

There has been an overall increase of 3.8% in national home values, and it’s important to note that this is slightly lower than the 4.3% increase over the 12 months to December.

Regional NT’s property market has experienced the highest decline in the 12 months to January 2025, with property values falling by -4.9%. Only 1 other regional area is declining— regional Vic(-2.2%).

Regional WA has experienced significant growth of 16.1%, with regional SA and regional QLD following closely at 12.2% and 9.7%. Additionally, some capital cities have seen double-digit growth in the past year, with Perth, Brisbane and Adelaide experiencing growth of 14.3%,9.7% and 11.9% respectively.

Canberra and Hobart have experienced some decline in the past 12 months to January 2025. However, the decline is a modest -0.9% and -0.3%, respectively. Melbourne has had the highest decline, at 3.2%, over the past year.

This data shows that the market is constantly changing and that growth is beginning to ease in almost all areas of the Australian property market.

Median Days On Market

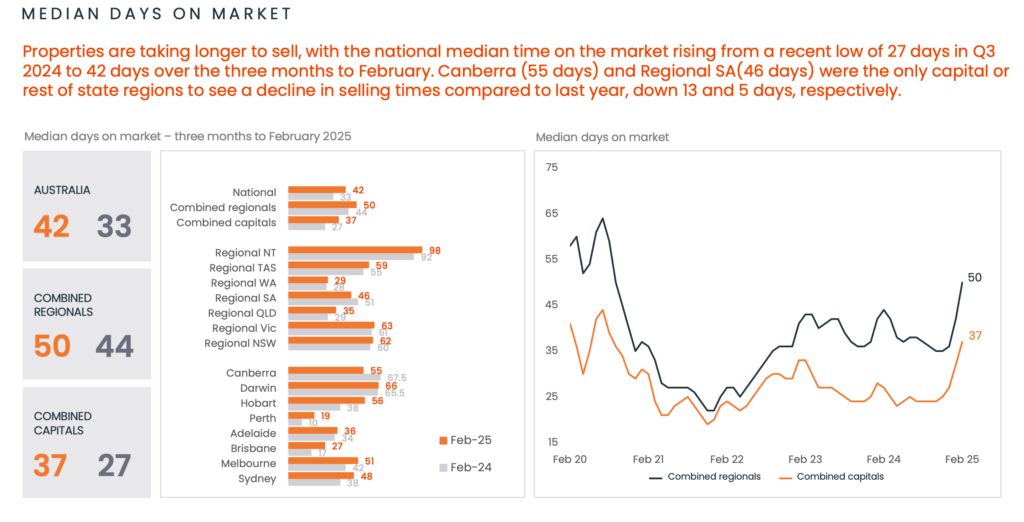

The median days on market statistic provides an important insight into the health of the Australian property market. This metric indicates the average number of days properties are listed on the market before selling. In the 3 months to February 2025, the overall median days on the market for Australia are 42 days, which is significantly higher than 33 days in the previous quarter.

Additionally, the median days on market for combined regionals is 50, and for combined capitals, it has increased by 10 days to 37. These numbers suggest that properties are now taking a slightly longer time to sell across Australian capital cities and in regional areas.

Overall, the increase in median days on the market across Australia suggests that the property market may be entering a cooling-off phase.

An increase in the median days on market can signal low demand in the housing market, where supply is higher than demand. The shorter the properties sit on the market, i.e. a decrease in the median days on the market, the more likely sellers will increase their prices as buyers compete for properties. This trend could lead to an increase in property prices in the future.

However, it’s important to note that other factors, such as seasonality, changes in government policy, and local economic conditions, can also influence this statistic. Therefore, it’s not necessarily an indicator of an immediate downturn or upturn in the property market. Other factors, such as interest rates, government incentives, and population growth, can still affect the market in the short and long term. It’s essential to monitor this metric along with other indicators to get a complete picture of the property market’s health.

Vendor Discount

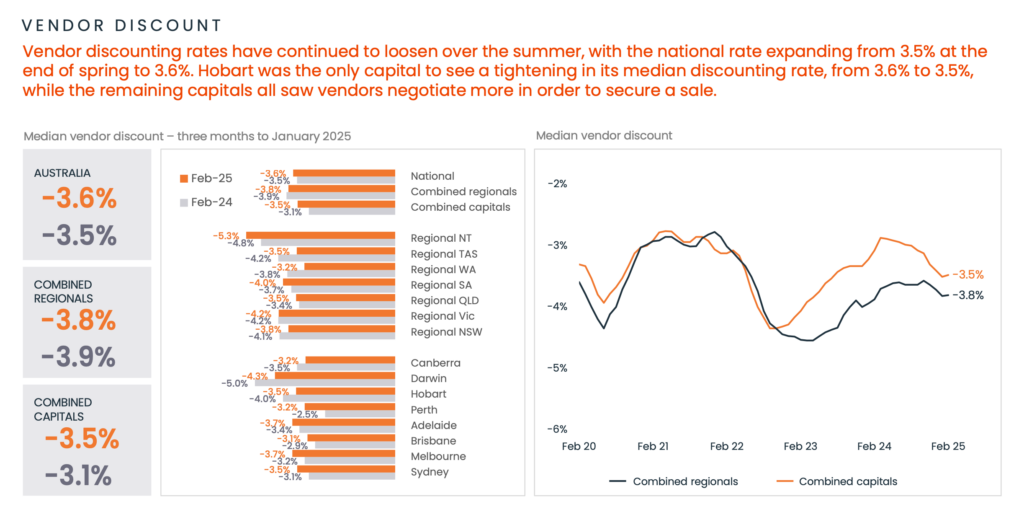

According to recent data from CoreLogic, vendors are now offering slightly higher discounts for all regions of Australia than they did the previous quarter.

In Australia, the average discount in the 3 months to February 2025 was -3.6%, which is 0,1% higher than last year. This indicates that sellers are still less willing to accept lower prices.

However, it is important to note that the discount rate is still relatively low, which suggests that demand for property remains strong in Australia. In conclusion, the decrease in the average vendor discount suggests that the property market in Australia is still relatively healthy. Buyers may still have opportunities to negotiate a better deal, albeit at a lower rate.

Mortgage Rates

The Reserve Bank of Australia’s (RBA) recent statement indicates that global inflation is still high but moderating due to lower energy prices, improved supply chains, and tighter monetary policy.

Some experts predict that inflation will not decline to the RBA’s desired 2-3% until the end of 2025 and unemployment is projected to reach 4.5% by mid-2025.

The RBA is closely monitoring labour costs, which are rising from recent low rates.

The big four banks expect that interest rate cuts will occur towards the end of the year since inflation is beginning to go down. These factors will impact mortgage rates for the Australian property market.

Market Analysis - Capital Cities

Now that we’ve taken a look at the overall Australian property market let’s dive deeper into the market for the country’s capital cities. The capital cities often hold a significant portion of the property market and are home to many of Australia’s major industries and institutions.

The property markets in these cities have seen significant changes, with some experiencing growth and others declining in value. By examining the data and trends for each city, we can better understand the current state of the Australian property market and what it means for homebuyers and investors. So, let’s take a closer look at each capital city and see how they have fared in the past year.

Sydney Property Market

In February 2025, the Sydney property market prices rose by 0.3%. However, affordability remains an issue, and Sydney houses are now more than double the price of units after reaching a new high in October 2024. This makes it very difficult for homebuyers to upgrade from a unit to a detached home.

Confidence in the market appears to be growing, and more investors are recognising that bargains can be found.

Most experts predict a modest increase in property prices in Sydney in 2025. Westpac predicts a 4% increase, and NAB predicts a 3.7% increase. On the other hand, AN is more optimistic about Sydney’s property market in 2025, as they predict a 6% increase in home values.

However, once buyers and sellers see that inflation is controlled and interest rates stop rising, they will return to the market.

The long-term outlook for the Sydney property market remains strong, with a unique lifestyle and economic benefits that will attract overseas migrants and plentiful jobs for highly paid knowledge workers.

Rather than trying to time the next property purchase based on where we are in the cycle, taking a long-term view and getting a foothold in the Sydney property market while others are sitting on the sidelines may be an ideal strategy.

Take a deeper look at the Sydney property market

Ready to take the next step in your Sydney property search? Check out our in-depth review of the best suburbs in Sydney to help you find your dream home! From up-and-coming areas to established neighbourhoods, our guide has everything you need to know about Sydney’s property hotspots. Don’t miss out on the opportunity to find your perfect home in one of the best suburbs in Sydney. Click here to read the full report now!

Read More: Best Suburbs in Sydney

Melbourne Property Market

The Melbourne property market experienced a decrease of -3.2% in the past 12 months and a rise of 0.4% in February 2025. Melbourne dwelling prices are now 6.4% lower than the record high of March 2022. However, there are many reasons to be optimistic.

Although Melbourne is experiencing a decline compared to other cities, house prices and rents are expected to rise in 2025. Prop Track forecasts that Melbourne dwelling values will grow between 3% and 6% in 2025.

Currently, Melbourne properties are selling after 42 days, compared to 39 days in February 2024, which shows decreased buyer activity in the market. Looking ahead, the long-term fundamentals of the Melbourne property market are strong.

With a median house price of $1,024,020 and a median unit price of $572,500, there’s a window of opportunity to enter the market before it picks up even more.

Brisbane Property Market

The Brisbane property market growth over the past 12 months has slowed down and is no longer in the double digits. However, Brisbane’s dwelling values are still at a record high, making it Australia’s second most expensive capital city. However, the rate of growth is slowing down.

The median house price increased by just 0.2% in February 2025. The number of new listings went up by 0.9% in the 12 months to February, which shows that supply remains pretty tight.

The median house price in Brisbane is expected to increase over the next year. According to ANZ, we can expect a 5-7% increase in property prices. Other experts predict a 6-8% increase.

With the 2032 Olympics on the horizon, Brisbane will surely receive a boost in international recognition and investment and an influx of highly paid knowledge workers.

With Queensland’s population expected to grow by over 16% by 2032, the long-term fundamentals of the Brisbane property market remain strong.

So, Instead of trying to predict the market cycle, now is a good time to buy property in Brisbane. Don’t wait for others to make a move; take advantage of the current conditions and get ahead of the curve.

Take a deeper look at the Brisbane property market

Ready to learn more about the Brisbane property market?

Don’t miss out on our in-depth report, which provides a detailed analysis of the market’s current state, growth prospects, and investment opportunities.

Click the link to access the report now and stay ahead of the game in the Brisbane property market!

Read More: Brisbane Property Market Update

Adelaide Property Market

Despite the uncertainty of the property market, the Adelaide market has shown significant growth in the past year. The median house value in Adelaide is currently at a record high and has increased by an impressive 11.9% in the 12 months to February 2025.

Factors such as population growth, a diverse economy, and limited stock have contributed to Adelaide’s price growth.

According to NAB, Adelaide is expected to grow significantly in the next 12 months. This may be good news for homeowners but will add to the affordability pressures. It’s important to remember that the extent of house value increases remains to be seen, especially as we await to find out if the RBA will further cut interest rates in 2025.

However, there’s still plenty of opportunity to exploit the current market conditions. Adelaide’s long-term outlook remains positive. If you want to enter the property market, now may be the perfect time to move and secure a property in one of Australia’s most resilient markets.

Perth Property Market

Perth is defying the odds and emerging as a bright spot in the Australian property market. Just like Adelaide, Perth dwelling values are currently at a record high! The Perth property market has shown resilience and remained an attractive investment option for buyers. This saw the median home values of Perth increase by an impressive 14.3% in the year ending February 2025.

With low vacancy rates, rising rents, and relative affordability, Perth is becoming a hotspot for investors from eastern states. Most property experts are optimistic about Perth’s market and predict continued growth over the next 12 months due to the low stock level and strong buyer demand.

Perth is a good city in which to buy property due to its relative affordability, rising population, and flourishing economy.

Hobart Property Market

The Hobart housing market improved by 0.4% in February 2025. Additionally, Hobart has experienced a decline of -0.3% over the past year.

The average sale price of a home in Hobart as of February 2025 is $875,000, which is nothing to sneeze at. The Hobart market presents a great opportunity for savvy investors to enter the market at a lower price point.

If you’re thinking of investing in Hobart, there are certain suburbs that you should definitely consider. West Hobart, North Hobart, and South Hobart are all areas still showing strong growth potential despite the broader price decline.

By taking a closer look at these areas, you may find some great opportunities to help you build wealth over the long term. So, while the past couple of months have been challenging for Hobart, there are still plenty of opportunities for those willing to put in the effort.

Darwin Property Market

The Darwin property market experienced a modest increase in median house prices of -0.1% in February 2025. However, it is still considered Australia’s most affordable capital city, with a median dwelling value of $585,912 as of February 2025.

The city has been in recovery over the past year, with a 0.9% increase in housing value. Despite these increases, Darwin property prices are now -6.0% below the record high which was in May 2014.

If you are looking for an investment property, then you should definitely consider Darwin. According to the latest data from realestate.com.au, gross rental yields in Darwin are 6.1% for houses and a sweet 7.3% for apartments. In fact, Darwin is the second most expensive capital city in which to rent a house.

The outlook for the next 12 months is positive, with the Darwin property market expected to rise, though not as high as the other cities. KPMG’s Residential Property Market Outlook report predicts that Darwin’s house prices will increase by 5.8% in 2025.

Darwin has much going for it, including a low-density population and a relaxed lifestyle. The city has seen an uptick in interest from investors and homeowners. Therefore, if you’re looking for a smart investment opportunity with positive long-term prospects, Darwin’s property market is definitely worth considering!

Canberra Property Market

House prices decreased by a small -0.9% over the past year. Moreover, the strong auction clearance rates throughout the year have been another sign of the strength of the Canberra property market.

There are also still government incentives to encourage first-home buyers into the market. The outlook for the next 12 months in the Canberra property market is bright, with some experts predicting up to 5% growth.

BONUS: Will Interest Rates Go Down In 2025

The Reserve Bank cut the interest rates by 25 basis points on 18 February 2025, reducing it to 4.1%.

This is the first reduction in borrowing costs since 2020. The Reserve Bank acknowledged that they’re being cautious with their outlook and that they’re going to continue to rely upon data and the evolving risk assessment to guide its decisions.

The Reserve Bank raised borrowing costs 13 times since 2022 but has held the cash rate at 4.35% for over a year as it waited for inflation to tick back down to its 2 to 3% target band.

So, what does this mean for anybody who wants to buy a house in 2025?

The reaction by the big four Banks was immediate, with Comm Bank, NAB, Westpac and ANZ all saying they will pass on the 4.25% rate reduction to their variable rate customers, which is massive. A person with a $500,000 home loan today will see their monthly repayments drop by about $76 after the rate drop. For borrowers with a million-dollar home loan, you could save $150 a month just from this most recent cut.

Will There Be More Rate Cuts This Year?

The question we’ve been asked a lot is, ‘Will there be more rate Cuts this year?’ All the big four banks are betting there will be further rate cuts this year, but they’re pretty split on how it will be cut.

ANZ said there could be one more cut, but it won’t be until August, forecasting a 3.85% cash rate. CBA predicts two more cuts, taking the cash rate to 3.35% in December. NAB is saying there could be three cuts getting the cash rate to 3.35%, and Westpac is the same. They’re saying there could be a whole per cent’s worth of cuts this calendar year, which is massive.

Source | Predicted Rate (End of 2025) |

ASX Rate Tracker | 3.35% |

ANZ | 3.85% |

Commonwealth Bank | 3.35% |

National Australia Bank | 3.60% |

Westpac | 3.35% |

The fear of missing out has been really powerful. Potential home buyers are worried that waiting for rates to fall will just mean prices will climb higher in the meantime.

It’s also worth mentioning that this isn’t happening evenly across the country. Every real estate market is different, and cities like Adelaide and Perth are seeing huge price jumps even with these high rates. Why? Affordability and supply vs. demand. So affordability is still better in Perth and Adelaide than in Sydney and Melbourne, and they just don’t have as many houses for sale, making competition pretty fierce.

Are interest rates going up in 2025?

You might have seen some headlines about Warren Hogan, one of the market’s economists, saying rates need to go up three times in the next couple of months. There are three key factors here that will drive the shift in interest rates, and there’s still potential for a downward shift.

Firstly, population growth. Population growth has massively impacted the Reserve Bank’s view on interest rates. The unexpected surge in population has really inflated demand, contributing to these higher prices. While long-term immigration can dampen inflation, short-term spikes can create the pressures we’ve seen in the property market. The government has said they will start cutting migration and immigration, which should put less pressure on the rates here.

Secondly, mortgage rate dynamics. The second thing the headlines are missing is some of the mortgage rate dynamics. There are still a lot of people on those long-term 2% fixed rates, which are coming off in late 2024 and late 2025. This is going to put additional pressure on households and means the Reserve Bank will be less likely to raise interest rates.

Thirdly, the labour market. Unemployment rates can potentially shift the reserve bank’s view. If unemployment rises, the RBA is least likely to raise rates and may actually start cutting them sooner to spur the market.

The main lesson here is that the property market doesn’t always follow the rule book. In fact, we’d say it probably never really follows the rule book—especially during times of economic transition like we’re in now. If you want to buy a home, the key is to focus on what you can control. So you can focus on your budget, getting a pre-approval, finding the right location etc. You can’t affect the interest rates so it’s just best to keep that in the background and focus on the things you can do now.

BONUS: Affordable Yet Booming Suburbs

Right now, many of these outer areas, like Ipswich and Logan around Brisbane or Elizabeth North in Adelaide, have seen median home values skyrocket in the past 12 months. Buying in a location that might be less than ideal could be a great way to get your first step on the property ladder and start building some equity.

So, let’s look at some specifics, starting with Brisbane and Perth. In Riverview, which is part of the Ipswich region of Western Brisbane, the average home value increased by $127,000 in a single year. This could absolutely change the game for first homebuyers. Typically everyone looks to buy their forever home— the place they want to live for decades. But if, for example, you had bought a home in Riverview last year, you’d have $127,000 of equity that you’d built in that house. If you want to upgrade in a few more years, then suddenly, you’ve got a pretty large deposit, and you can start looking at finding your forever home. It’s a similar story in Adelaide suburbs North of the City, like Elizabeth North and Elizabeth South, which have seen house prices surge by over 30% in the past year — so it’s not just limited to Brisbane. In Perth, areas like Girrawheen and Kelmscott have median prices jump over $150,000 in just one year.

You may be saying, well, it’s cheaper, but do I really want to live in Logan or Ipswich? Is it worth sacrificing that lifestyle to get my first home and get on the property ladder? It’s a totally valid concern, and it’s about finding the right balance. There’s no one-size-fits-all solution, but for some people, the financial gain might outweigh the lifestyle compromises. Not to mention, there’s always the concept of rent vesting, which we’ve discussed in this article. You might even want to look at your first home as an investment home; that way, you can have the best of both worlds. Remember, the sooner you’re in the market, the sooner your money starts to work for you.

BONUS: What Could Cause The Australian Property Market To Crash in 2025?

So, first off, a housing market crash isn’t just one bad auction. A market correction is considered a price reduction of 10 to 20%. A market crash is considered a reduction of 20% or more, and it doesn’t happen overnight. It can take months and sometimes years for this to occur. In fact, in Australia, the last time we had anything close to this was in 1990, the recession we had to have. The crazy thing is the downturn in housing was pretty mild. From peak to trough, prices declined nationally by just 8% in real terms. Compare this to the stock market, where we had Black Monday in 2020, and the ASX lost 30% from its peak in March 2020 and had a record 9.7% loss in a single day.

That said, what actually causes the housing market crash? Let’s dive into the factors that can actually cause a market downturn.

- Higher household debts. The average household debt level grew by 7.3% in 2023, and it would be worth keeping an eye on these debt levels to ensure that people aren’t getting in over their heads. However, the Australian banking system is heavily regulated. Banks are still required to use a 3% buffer, so if you’re applying for a loan today, the banks will add a 3% buffer from the current rates. So, if the interest rates are 6%, they will assess your loan at 9%.

- Overvalue or oversupply of properties. Realistically, the high value of properties in Australia is due to a limited supply and attractive affordability for investors. The gap between housing supply and demand pushed property prices up in 2023 and could potentially keep pressure on in 2024. But it could take it off if a huge glut of properties suddenly built in a short period and hit the market. But this looks pretty unlikely.

- Massive Global shocks like the Global Financial Crisis or Covid. While the COVID shutdown weakened growth and momentum in the United States and the European Union, it didn’t really have the same impact on our property Market that it did overseas. The risk of a local recession could cause a cascading effect, where if the economies overseas slow down, it could mean less work here, unemployment could increase, and that would affect housing. But also, as we saw during COVID-19, when people let go of their jobs, the banks stepped in and allowed people to have 12-month interest-only periods. So again, while that could happen, it looks pretty unlikely, given the current economic indicators.

BONUS: What Happens To Your Home If Prices Plummet?

We’ve all had this nightmare before: You finally achieve your dream of owning a home. After years of saving, you’re finally holding the keys to your home in your hands. You have that feeling of satisfaction that you’ve finally made it—only to overhear the news and find out the property Market in Australia is tanking. So, let’s break down what would really happen if you bought a home and the property market took a complete nosedive.

How is real estate valued in Australia?

Firstly, let’s start by understanding how homes are valued. How do you actually know what your house is worth? A lot of people talk about Market values, appraisals, and Renovations when discussing the property market, but when it all comes down to it, the true value of a home is what someone else is willing to pay for it.

What happens if you buy and the market crashes?

All right, so to answer the question, what happens if you buy and the market crashes? To paint a clear picture, let’s dive into some hypothetical scenarios of what could happen if the market takes a tumble.

Meet our friends Stretched To The Limit Liam, Savvy Sam, and Timid Taylor. Each represents a different approach to buying a home, and each will face the market’s ups and downs in a unique way.

Stretched To The Limit Liam.

Liam went all in when buying a house, pushing his financial limits to the max. His mortgage payments take up more than half of his income. When the market takes a dive, Liam’s financial flexibility dives with it. Refinancing isn’t an option because the bank says he doesn’t have affordability, and selling would mean he’d take a loss. Liam’s tale is a cautionary one. It’s pretty generalized, obviously, but it shows that overextending yourself can turn your housing dream into a financial nightmare if the market turns sour.

Savvy Sam, The Prudent Buyer.

Sam’s the kind of person who reads the fine print, plans for the unexpected and has an emergency fund tucked away. By choosing a home that is well within her means, Sam’s mortgage payments are manageable and not monstrous. So when the market downturn hits, Sam stands firm. The housing values might dip temporarily, but she’s in it for the long run and can weather the storm without upending her life. The main takeaway here is having some emergency funds and having 3 to 6 months in repayments as a buffer if something happens to your job. Insurance is in place to make sure you can weather a storm if something happens.

Timid Taylor The Observer.

Taylor’s watching from the sidelines, hesitant to dive into the market and the home-buying pool amidst all the market uncertainty. By holding off buying, Taylor avoids the potential of a market crash — no worries about falling homes or values or mortgage Mayhem. But Taylor misses out on potential joys and benefits of home ownership, like building Equity or catching the market back on its way up. Now, Taylor’s path might be safest, but it’s also worth remembering when you play it safe, you miss out on opportunities to grow.

So whether you’re Stretched To The Limit Liam, Savvy Sam, or Timid Taylor, the key to navigating a housing market downturn is understanding your financial landscape and making choices that align with your long-term goals. Remember, the goal of home ownership isn’t just about buying a house; it’s about doing it the right way so you can enjoy it come rain, hail, or shine.

By working with a mortgage broker, you can plan wisely, understand your limit, and ensure a dip in the market is just a bump in the road, not the end of your journey.

Looking To Buy A Property Anywhere In Australia? Here Are Your Next Steps

If you’re looking to buy a property anywhere in Australia, Hunter Galloway has you covered. Our team of experienced brokers can help you navigate the often complex and overwhelming process of buying a home, no matter where you are in the country.

With our help, you can secure the best possible loan for your unique financial situation and take advantage of the current market conditions. Don’t hesitate to take the first step towards your dream home. Call us today at 1300 088 065 or

Unlike other mortgage brokers, who are one-person operations, we have an entire team of experts dedicated to making your home loan journey as simple as possible.

If you want to get started, please give us a call on 1300 088 065 or book a free assessment online to see how we can help.

Start again

Start again