The journey to homeownership is an exciting one, filled with anticipation and dreams of creating lasting memories in your new home. However, it can sometimes feel like you’re sailing in uncharted waters, especially when financial terms like ‘interest rate hikes’ are thrown into the mix.

In this post, we’re going to explore what interest rate hikes mean for you.

To learn more, read on or watch the video below:

Table of Contents

The Anatomy Of Interest Rate Hikes: A Crash Course For First Homebuyers

Let’s start by getting familiar with the beast: what is an interest rate hike, and why does it matter to you?

Interest Rate Hike 101: Simply put, an interest rate hike is when central banks, like the Reserve Bank of Australia (RBA), increase the cost of borrowing money. If you’ve taken out a mortgage on your home, an interest rate hike could mean higher repayments.

Economic Indicators: An increase in interest rates often signals that the economy is recovering and expanding. Central banks use rate hikes as a tool to keep inflation in check. While this is generally good news for the economy at large, it can result in higher costs for borrowers.

Riding the Wave: Interest rate hikes don’t happen every day. They typically come in waves or cycles, tied closely to the economic climate. Timing your entry into the property market can make a difference to the interest rates you’ll encounter.

Expert Forecasts: A Glimpse Into The Financial Crystal Ball

It’s always helpful to get a bird’s-eye view from those who watch the markets closely. Let’s take a look at what some experts predict:

- Diane Musa, economist at ANZ: Diane Musa has warned of potential upcoming rate hikes. For first homebuyers, her insights highlight the importance of factoring potential rate increases into financial planning.

- Louis Christopher, Managing Director of SQM Research: According to Christopher, we could see significant interest rate rises in the near future. This prediction underscores the importance of careful budgeting and exploring mortgage options that could provide some protection against rising rates.

Steering the Ship: Practical Tips for Managing Mortgages Amidst Rate Hikes

Armed with understanding and foresight, you’re ready to take the helm. Here are some practical tips to navigate your mortgage in the face of interest rate hikes:

- Prepare for the Tide: Forewarned is forearmed. Budget for potential rate rises, not just the current rate. This can provide some buffer should rates increase.

- Explore Fixed Rate Mortgages: These mortgage options provide certainty of repayments over a set term, protecting you from rate rises during that period. They can be a good option if you prefer stability in your budgeting.

- Seek Professional Guidance: Every homebuyer’s situation is unique. Seek professional financial advice tailored to your circumstances. This can be immensely helpful in making informed decisions.

Deciphering the Reserve Bank of Australia's Rate Increases

The Reserve Bank of Australia (RBA) doesn’t decide to increase rates on a whim. There’s a careful, calculated decision-making process behind each rate increase. By keeping an eye on the RBA’s statements and understanding their economic outlook, you can better grasp how these decisions might impact your mortgage repayments.

Forecasting the Financial Future: An Ongoing Voyage

Firstly, it’s important to understand the global context because what happens overseas can indeed impact the Australian economy. ANZ is predicting that significant rate cuts will not happen until mid-2024. They’ve also adjusted their growth forecasts for Mainland China downwards due to a lack of response from the housing sector and demographic shifts. As the Australian economy is closely linked to China, particularly in the resources sector, any slowdown in Chinese demand can affect us here.

However, at the moment, we’re seeing that interest rates in advanced economies are still rising, despite some expectations to the contrary. ANZ doesn’t foresee the US, EU, or UK to start easing until the second quarter of 2024 and Australia and New Zealand until the third quarter of 2024. So, interest rates globally are currently on an upward trend.

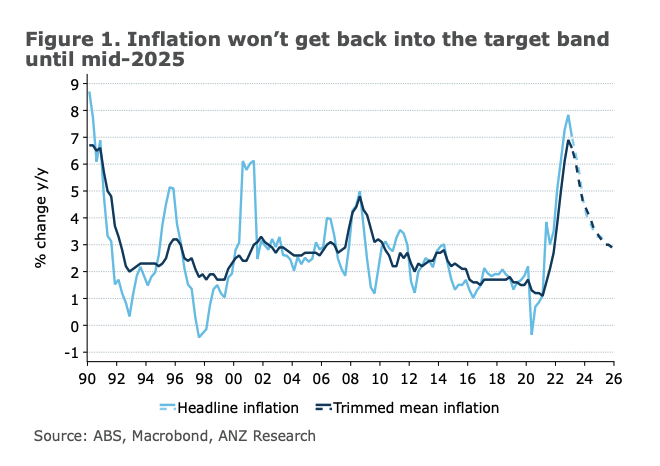

For Australia, it’s important to consider the current state of inflation. Despite strict monetary policies, inflation remains high and slow to subside. The recent CPI reading showed an unexpected surge in inflation. This surge is primarily due to weak productivity and rapidly increasing unit labour costs. With wage growth expected to increase into 2024, the RBA is likely to implement further measures, potentially peaking the cash rate at 4.60% in August per ANZ’s assessment. We’ve even seen some economists forecast the peak to be higher than this.

While no one can predict the future with complete certainty, current trends suggest that rate hikes may continue for a period. Remember, fluctuations in interest rates are a natural part of the economic cycle. Staying informed and prepared is key to riding these waves with confidence.

Conclusion: Your Voyage Towards Financial Confidence

Interest rate hikes may seem like intimidating storms on the horizon, but armed with knowledge and preparedness, you can navigate them with confidence. Remember, you’re the captain of your financial ship, and while the seas may sometimes be choppy, you have the tools and resources to steer a course towards secure homeownership.

Your Trusted First Mate: Hunter Galloway

Ready to set sail into the sea of homeownership? At Hunter Galloway, we’re here to be your trusted first mate, guiding you through every twist and turn of the journey. Reach out to us today for personalized financial advice, and take the first step towards confidently steering your financial future.

Start again

Start again