This is the most comprehensive guide to getting a self-employed home loan in Australia.

If you’re self-employed, then you know it’s a lot of hard work. All that hard work means that you deserve to live in the house of your dreams, but try and tell the banks that, and it’s a very different story. Getting a home loan as a self-employed person is complex and sometimes nearly impossible. But don’t despair…

In this article, we will show you the exact techniques and information you need to know before applying for a self-employed home loan in Australia.

PLUS, we’re going to look at a massive home loan change for self-employed buyers, which can make the process faster and smoother…

So, if you work for yourself or get paid through your tax return, you will love this guide.

Table of Contents

How To Get A Home Loan When Self Employed?

Working for yourself has lots of perks – you can decide your working hours, you can choose the people you want to work with, and the biggest advantage is you have control over your income.

However, the biggest advantage of being self-employed is also the biggest disadvantage when it comes to getting a home loan, as the banks will sometimes make it harder to get a home loan…

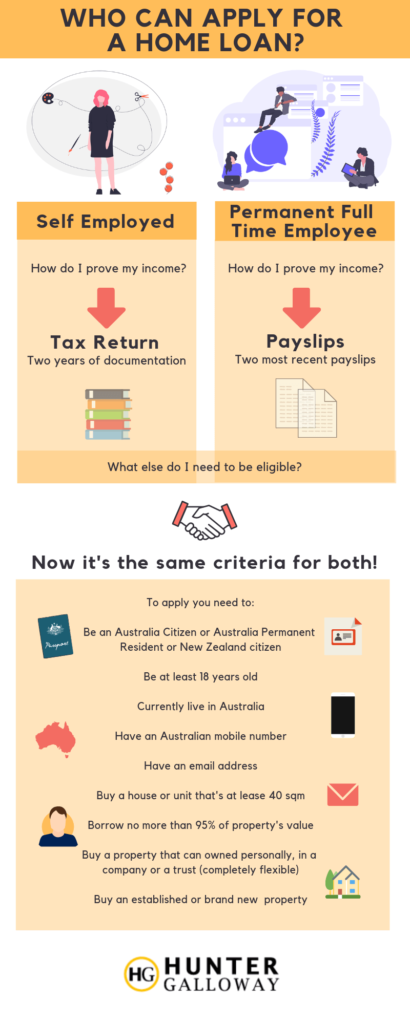

Often, those who are self-employed are asked many more questions and need to produce much more information than people who are in permanent full-time employment.

Why?

Because most lenders are looking for a stable income, which can be hard for some people who work for themselves.

The difference between self-employed home loans and regular loans is that as a self-employed borrower, you need to submit two years’ worth of tax returns, financials and notices of assessment, plus all the questions that come along with everything to do with the finances on your application. Now, this means a lot of plotting around to find your tax returns and have them completed. You must also have been trading in your business for at least 18 months.

But then, from there, it is the same for everyone.

Self-Employed Home Loan Common Issues

Generally speaking, lenders are often cautious when it comes to dealing with those who work for themselves.

In the past, lenders have found that self-employed people don’t always have as much financial stability as their employed counterparts – which is not true at all in our experience.

A few other common issues we have seen include:

- You need to have been in business for at least 18 months or in the same industry for at least 2 years. We usually see this issue with Contractors who might have received a salary in the past and are now self-employed.

- The business is trading, but you have a clever accountant who has reduced your tax bill – but as a result, your tax returns may not show enough profit to service your loan. If this is the case, you can look at Low Doc loan options or review your tax returns with your accountant.

- You have rapidly expanded the business, and profit has increased over 20% year on year. Now, the banks are asking lots of questions. However, there are banks that will only require the most recent year’s tax return because they understand businesses can grow rapidly.

- The lender is using the lower figure from your past 2 years of tax returns. Many banks will adopt the lowest profit figures from your past 2 years of income. The good news is we have lenders that will use your most recent figure, or possibly the higher one or the lowest at 120% of profit, depending on the situation.

The fact is, if you’re self-employed and #killingit, then you’ve got nothing to fear because, at Hunter Galloway, we are dedicated to making sure you get the best self-employed home loan available.

What Does A Lender Look For In Self-Employed Applicants?

Lenders are looking for financial stability and the ability to prove the following.

- Last 12 to 24 months Tax returns

- Sometimes, they will want a letter from your accountant to confirm your business is trading profitably

- At least 18 months to two years of proof of solid income

All this information is about showing the lender that you’re not a high risk, so the more proof you have, the better the outcome will be.

The Rise of the 2024 Entrepreneur

It’s no secret that a growing number of people in different fields are choosing to work for themselves, whether running a small business, freelancing or doing consultancy. Usually, this method of working is structured as a sole trader and is completely fine to get your loan approved.

Here are some ways that we can help the lenders rest easy, and you can be confident in your application as a self-employed individual.

Application For Self-Employed Home Loan

When you are applying for a home loan when self employed what do the banks look for? Here is a list:

- You have more than two years of self-employed experience. Lenders want to see that you’ve got a bit of history working for yourself in your field. If you have less self-employed experience than this, then they are looking for you to demonstrate how you have worked in the field over the years. So, if you’re a freelance makeup artist, the lender will want to see that you worked as a makeup artist for a company earlier in your career. Keep old payslips and get references to help prove this.

- You have less than one year of experience. This will make it harder for you. More often than not, banks won’t want to loan to you if you’ve worked for yourself for less than 1 year. They want to see proof of income, but depending on the lender, you may be able to use the wage from your previous employment to help build your case.

- Tax returns are very important. Lenders will look closely at your tax returns to determine how much you earn. So make sure you have these handy. They are going to do some forecasting to figure out if the business is growing and if your income is stable. What they focus on changes, depending on the lender. Some will go off your lowest income in a certain period, and others will use your most recent tax return.

- Lenders also track industry data. It feels like they have eyes everywhere, right? But they do track industry data. This means that they look at other applicants in your industry and see how they’re doing. If many people in your industry are defaulting, which has risen over the past few years, this can work against you.

How Can I Get My Tax Returns Looking Perfect?

Now that we’ve determined that your tax returns are practically the lifeblood of your application, it’s important to know what lenders look for in tax returns.

Each tax return you send across needs to come with a notice of assessment, which the lender will use to check the signatures and certification to make sure everything matches. The lender will look at your tax return in detail and may even ask for further documentation, depending on whether you’re a company or a sole trader.

Next, they review any odd expenses that they don’t see as part of your regular business. In some cases, they may add this to your income to determine a more realistic figure; others won’t. This is called an add-back. These expenditures can reduce your taxable income, so the lender recognises this as something other than an ongoing expense.

What’s An Example Of An Add-back?

- Interest paid on a business or personal loan

- Extra contributions made to your superannuation fund

- Depreciation on taxable assets

- Net profits you retain in a company

- Any income distributed to others through a trust

- One-off expenses that don’t show up on other tax returns

- Company cars also can sometimes be considered an add-back expense.

Which Banks Are The Best For Self Employed Loans?

Banks’ policies on home loans for self employed people change all the time.

We have included a snapshot to give you an idea of what the major bank’s criteria are for self-employed loans.

The table below tells you the bank’s income criteria depending on whether they use your current year’s income, the lower of the past 2 years’ income or an average.

- Current Year’s Income: The bank will use your current financial year’s income. So, for example, if you had an average income year in FY22, and then in FY23 had a much better year, the bank will use the higher figure and (potentially) look at lending you a higher figure. So, for example, if in FY22 you made $20,000 and then in FY23 you made $100,000, the bank would adopt $100,000 and increase your borrowing capacity significantly.

- Lower of Past 2 Years’ Income: The bank will use the lowest of your past 2 years’ income or profit figures. So, for example, if you had a great year in FY22, making a profit of $50,000 and then a bad year in FY23, making a profit of $40,000, the bank will use the lower figure of $40,000, which will reduce your borrowing power.

- Average of Past 2 Years’ Income: The lender will use the average of your past 2 years’ income. So, for example, if you earned $50,000 in the 2023 financial year and earned $70,000 in the previous financial year, the bank will adopt the average of the two or $60,000 as your income figure. This can also reduce your borrowing power. Some banks will even just adopt 120% of the lower figure, which still works out to be $60,000 in this case.

ANZ | CBA | NAB | Suncorp Bank | Macquarie | Westpac | |

Current Years Income | Yes, if less than 80% LVR | Yes, if less than 80% LVR | ||||

Lower of the past 2 years Income | Yes, up to 90% LVR | |||||

Average of the past 2 years Income | Yes, up to 95% LVR | Yes, up to 90% LVR | Yes, up to 95% LVR |

There are banks that have even more flexible criteria for self employed people. Speak to our expert Mortgage brokers about your situation. Call us on 1300 088 065 or complete our online form for a callback.

Where Do Business Loans Sit?

Depending on how your business is set up, some lenders will send you to the business department. However, beware of setting up a loan as a business, as it won’t benefit you if you’re using your residential property as security on the home loan. Instead, it will only result in more fees and a higher interest rate. So, look for a lender that offers standard residential rates. Our team of experts will help you with this situation through an in-depth consultation.

Read more: Five questions to ask your mortgage broker.

What About A Low-Doc Loan? Am I Eligible?

You could be. But, again, it really comes down to the lender and whether they will allow you to submit an income declaration instead of your tax return. This will then be used to decide whether or not they will give you a home loan.

The problem with low-doc loans is that they come with strings attached. For example, your borrowing capacity will be lowered, and you’ll be charged Lenders Mortgage Insurance (LMI). So it really comes down to your priorities and what’s more important to you.

In fact, many banks are starting to get rid of the low doc loan option. This is so that they can simplify their offerings. On the flip side, getting rid of low-doc loans may make it more difficult for small to medium-sized businesses to obtain a home loan when their income doesn’t meet the lending criteria.

These days, you still need to provide some documentation with low doc loans. This includes:

- Business Activity Statement (BAS) for the last 12 months showing your annual revenue

- A letter from your accountant confirming your total income

- Business banking statements showing your income

- Older tax returns from 2+ years ago

- Management accounts, or profit & loss statements

BONUS: Massive Home Loan Changes For Self Employed/Business Owners.

The banks have made it easier to get a home loan by accepting your self-employed salary as an income in the assessment without too much verification required. So, if you’ve been getting a regular salary from your business, you can use this to apply for a home loan instead of a mountain of paperwork.

All you have to do is submit any one of the following three things:

- Proving six months salary credited into your bank account.

- Showing a pay slip with more than six months year-to-date on the payslip itself.

- If you have less than six months year-to-date on your income payslip, you can actually provide a pay slip plus your pay-as-you-go summary or a financial tax return to show your income is consistent.

Remember, you only need to submit one of these three. However, regardless of which option you choose, you will need an accounts letter on company letterhead with the date your business started, a statement saying your salary is regular and continuing, plus evidence that there’s enough profit for your business to sustain itself.

With this new method, the bank only uses your salary to assess your ability to repay your loan. They will ignore any profit your business is making, no matter how big it is. But that shouldn’t be a problem as long as you can afford to repay the loan.

This change is a big win for many business owners with a company structure that they’re paying themselves a salary through the company, and they don’t really want to go into the weeds about their business by providing all the financials. This works well if you just want a quick and easy solution.

Unfortunately, if you’re a sole trader, you’ll often pay yourself to your own ABN, so you still need to provide your financials to the banks for the last two years.

Another thing that’s worth mentioning is that if you’re thinking of buying an expensive mansion and your borrowing is limited, it’s better to provide your financial statements of your business or apply for things like low documentation loans where the banks can potentially extrapolate a little bit more income than you might be paying yourself as a wage.

This is where working with a mortgage broker can really help you because they can guide you in the right direction. They can help you choose from the following 3 options:

- The low doc option, where you provide less information, but you might be able to increase your borrowing ability

- The full documentation path where you still provide two years’ worth of documentation, but you can extrapolate your profit and use that in your income

- The new methodology where you just use your income that you’re receiving from the business and really go from there.

Next Steps And Settling Your New Home

Our team at Hunter Galloway is here to help you buy a home in Australia. Unlike other mortgage brokers who are just one-person operators, we have an entire team of home loan experts dedicated to helping make your home loan journey as simple as possible.

If you want to get started, please get in touch here, and we can book a time that suits you – either a phone call information session or a face-to-face meeting (which doesn’t cost anything for you).

Further Reading For Home Buyers…

- Comprehensive first home buyer guide

- 16 Hidden costs of buying a home.

- Home loans for lawyers – the complete guide

- Can I get a home loan with no deposit?

- First home buyer stamp duty

Note: Information is current as of November 2023 and subject to change without further notification. Any home loan application is subject to credit approval and verification of all supporting documentation. Consider this article as general in its nature and not as advice.

Start again

Start again